When I spoke with the founders and early employees of famous two-sided marketplaces such as Airbnb and Thumbtack, I consistently heard the same story: acquiring sellers was the focus early on, but it became harder to grow the buyers at a suitable rate over time. This is a natural progression for two-sided marketplaces, and balancing buyers and sellers is probably one of the most difficult problems in the growth stages of a company.

A two-sided marketplace is any platform where buyers and sellers come together to transact: drivers sell their services on Uber to riders, who act as buyers; hosts sell their room nights on Airbnb to the guests that buy them. In order to get initial traction, the marketplaces need both buyers and sellers to use the platform. But why are sellers more important early on? And how quickly should marketplaces grow buyers compared to sellers?

Onboarding sellers early on is critical because of the frequency of transactions

There are two reasons why marketplaces need to grow the number of sellers more quickly early on:

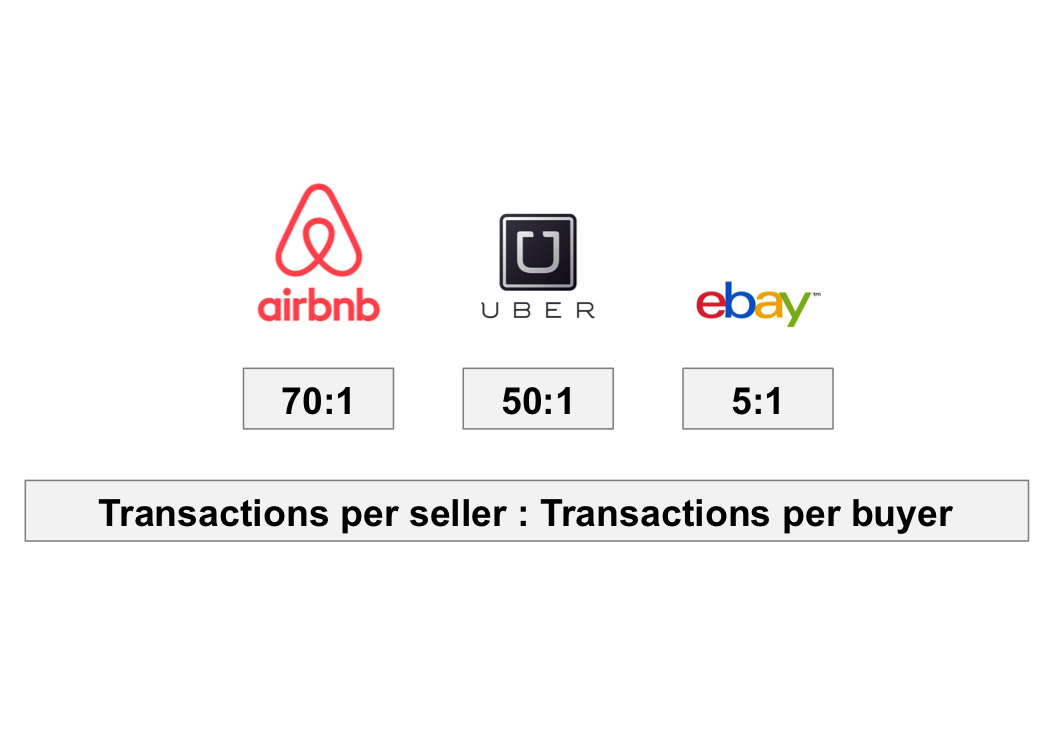

- Since sellers transact more frequently, they are instrumental in creating repeat business early on: Uber drivers give on average 6 rides per day while customers take on average one ride every 8 days (Disclaimer: all numbers are back-calculated from publically available data that are snapshots of different points in time. In addition, these are realized averages that do depend on marketplace supply and demand.). Similarly, Airbnb hosts average one stay every nine days while guests average one stay every two years. Even on eBay, sellers transact once a week while buyers transact once a month. Startups trying to attain early traction need to dedicate resources to acquiring the users that can provide more transactions in a given time frame.

- Idle sellers are less dangerous than idle buyers: Airbnb hosts who have trouble renting out their rooms might choose to post on Craigslist or Homeaway simultaneously, but they are unlikely to leave the platform altogether given the low cost of keeping a posting open. The perception that they might get business once in a while can be enough to motivate them to stay with Airbnb. On the other hand, for a traveler looking for lodging on any given night, she will perform the purchase off-platform if she can’t find a suitable seller on Airbnb. Over time, if Airbnb disappoints enough times, the buyer may no longer check for on-platform purchases. Not only do buyers tend to have more alternatives than sellers because institutional sellers exist (hotels, taxis, etc.), but also buyers are harder to retain because of their less frequent transactions.

Optimal growth in the number of sellers and buyers is determined by customer lifetime value

Optimizing the growth in number of sellers and buyers depends on many factors, including timing and location idiosyncrasies. However, the ballpark numbers can be inferred by looking at retention rates and transaction frequencies.

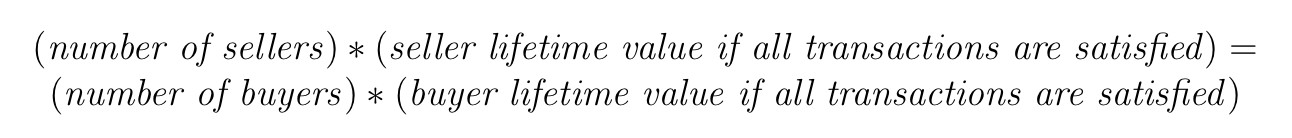

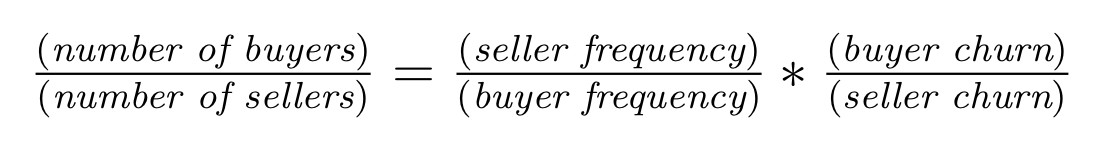

In a marketplace that fully satisfies sellers and buyers, the following equation holds:

Therefore,

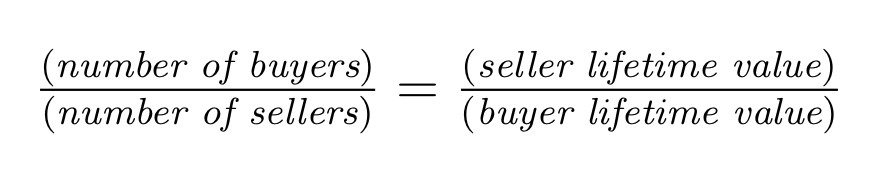

By the definition of lifetime value (discount rates are ignored for this analysis since it remains consistent for buyers and sellers),

The gross margin per transaction is the same for buyers and sellers from the point of view of the marketplace. Therefore,

Interestingly, churn also depends on frequency, though the relationship differs by marketplace. In general, though, the less frequent a party performs a transaction, the higher the likelihood of churn.

What this means for Airbnb and Uber

The frequency of transactions for an Uber driver is much higher than the frequency of transactions for an Uber rider. Similarly, the frequency of transactions for an Airbnb host is much higher than for an Airbnb guest. Looking forward, these companies will have to grow their buyer base much more quickly than their seller base. In addition, as these companies determine their steady-state churn rates on both sides over time, the data could suggest that the growth needs to be more lopsided than before.

This creates an important contrast to the traditional two-sided marketplace: eBay. eBay sellers do transact more frequently than buyers, but the ratio is an order of magnitude smaller compared to Uber and Airbnb. Growth in these marketplaces cannot be measured the same way as growth was measured for Ebay.

Originally published on http://www.onlineeconomy.org/

Author: Phil Hu